Awesome Info About How To Buy Credit Default Swaps

The reference entity is usually a bond, loan, or other.

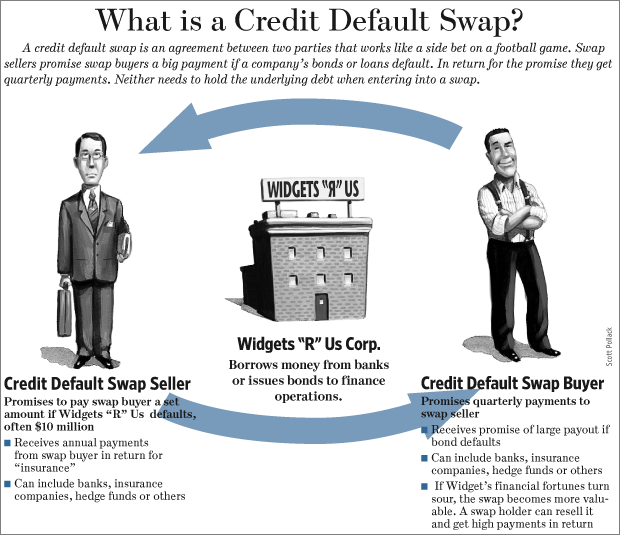

How to buy credit default swaps. A large investor or investment firm can simply go out and buy a credit default swap on corporate bonds it doesn’t. Example of credit default swap. (net buy or the net sell).

Putting on this trade gives you synthetic exposure to. If a lender is concerned about a borrower,. In return, the cds buyer.

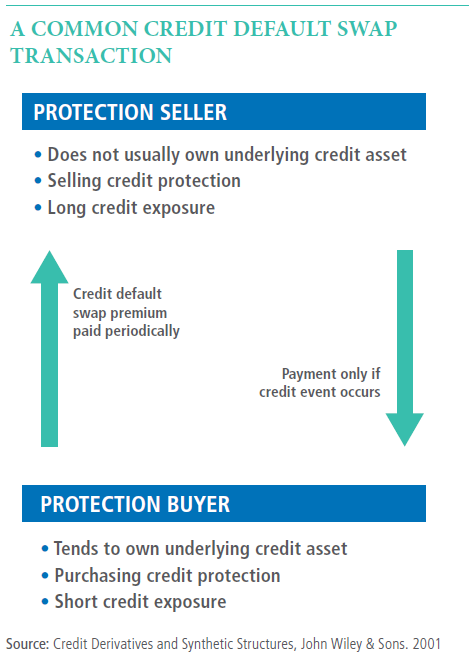

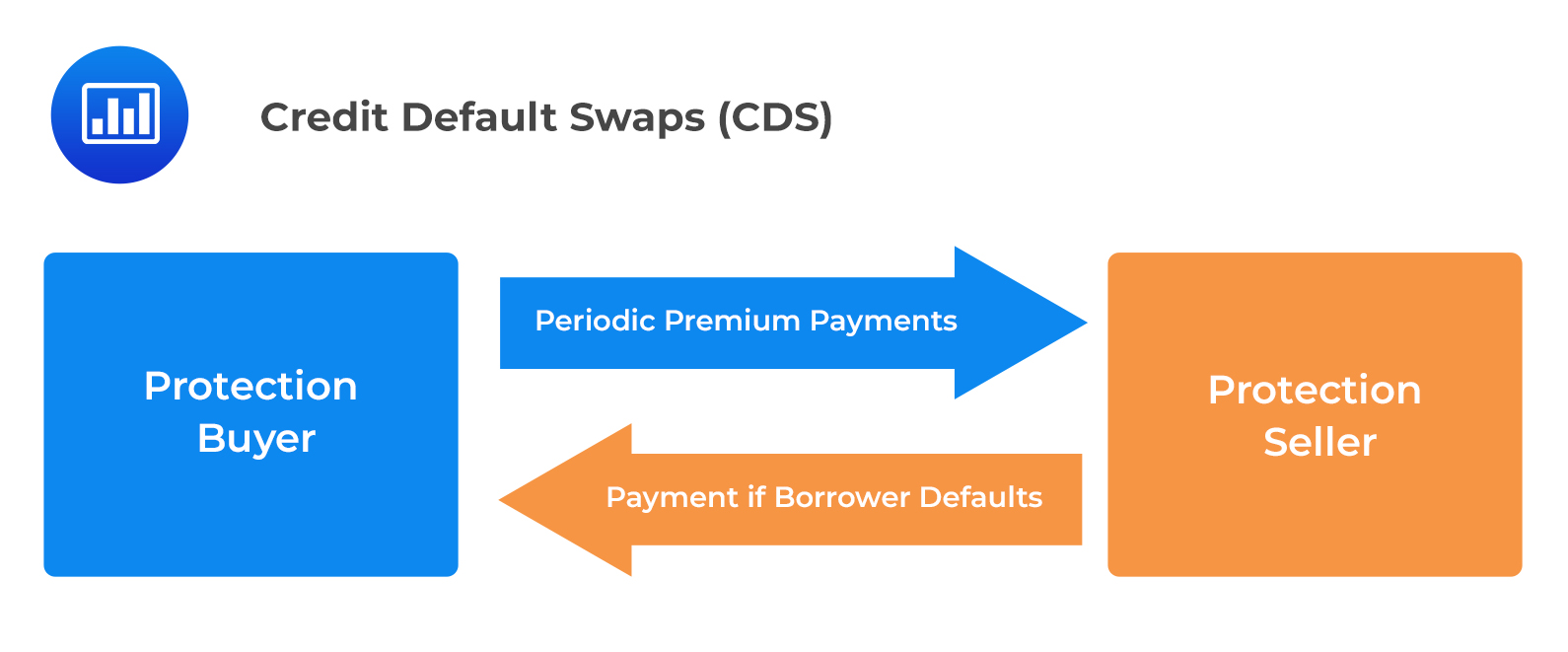

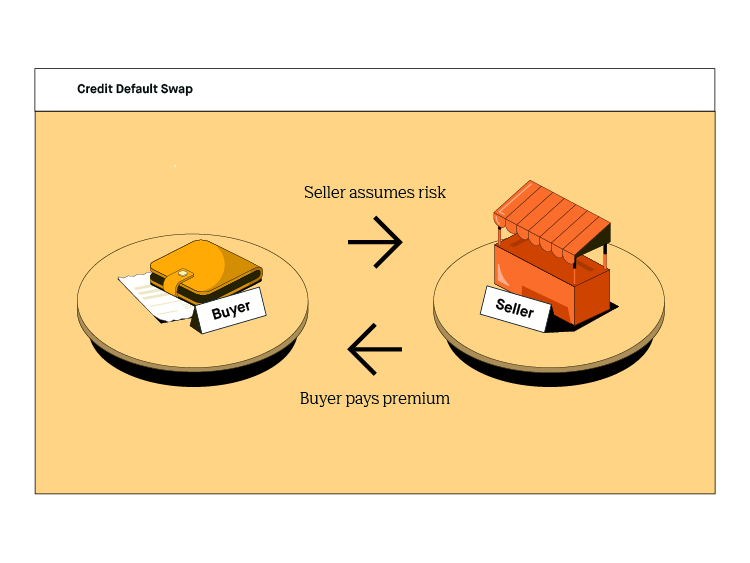

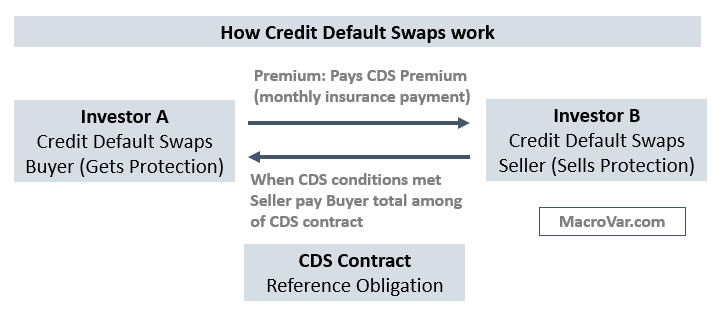

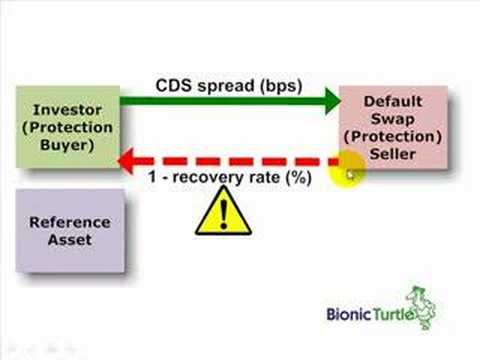

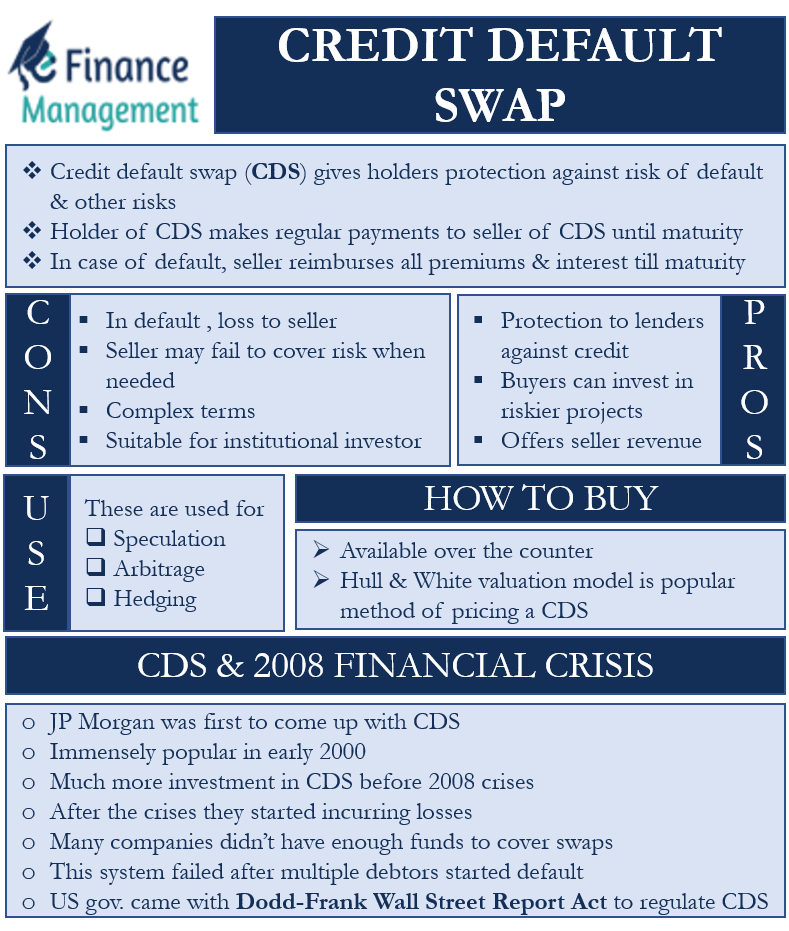

How do you buy credit default swaps? A credit default swap is a financial derivative/contract that allows an investor to “swap” their credit risk with another party (also referred to as hedging ). Speculators can use credit default swaps in one of the following two ways to try and boost their returns:

Naked credit default swaps have increased the liquidity and scope of the credit default market, as investors selling and buying naked cdss can speculate on the financial health of the asset. How to buy credit default swaps can you buy credit default swaps? In return, the seller agrees that, in the event that the debt issuer.

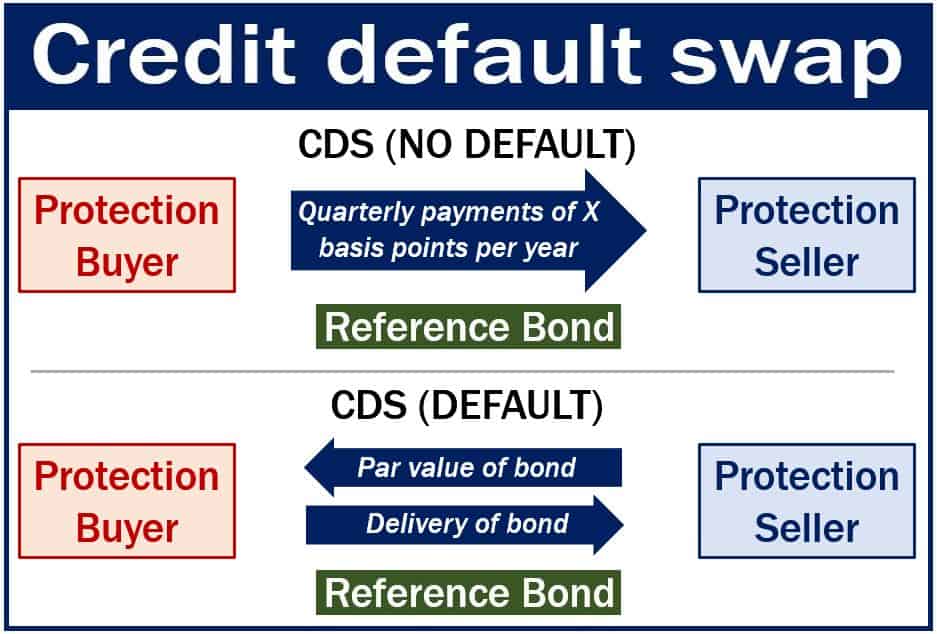

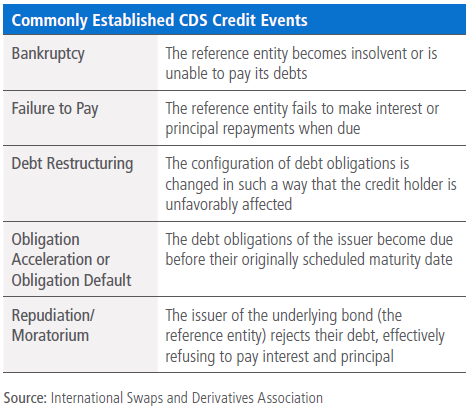

A credit default swap (cds) is a financial contract that allows one party to transfer the credit risk of a reference entity to another party. In a credit default swap, the buyer of the swap makes payments to the swap’s seller up until the maturity date of a contract. This is also known as hedging.

The imm is published for viewing and used in the. Walmart numbers came out this morning and there is barely any sign of recession. One common way is by buying a credit default swap(cds).

:max_bytes(150000):strip_icc():gifv()/TermDefinitions_Creditdefaultswap_finalv1-b682ce0e781d489db695637c6f884a82.png)