Fun Tips About How To Reduce Taxes Ira

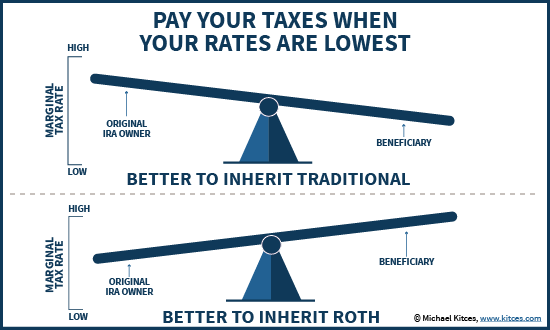

There are not many ways to reduce this tax burden.

How to reduce taxes ira. $208,000 and up for married. Here are 5 ways to reduce your taxable income 1. You can turn around and take that.

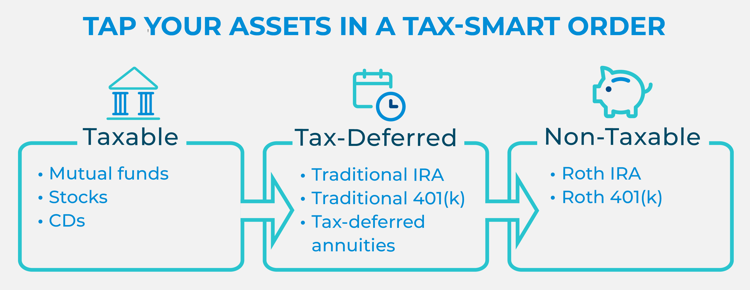

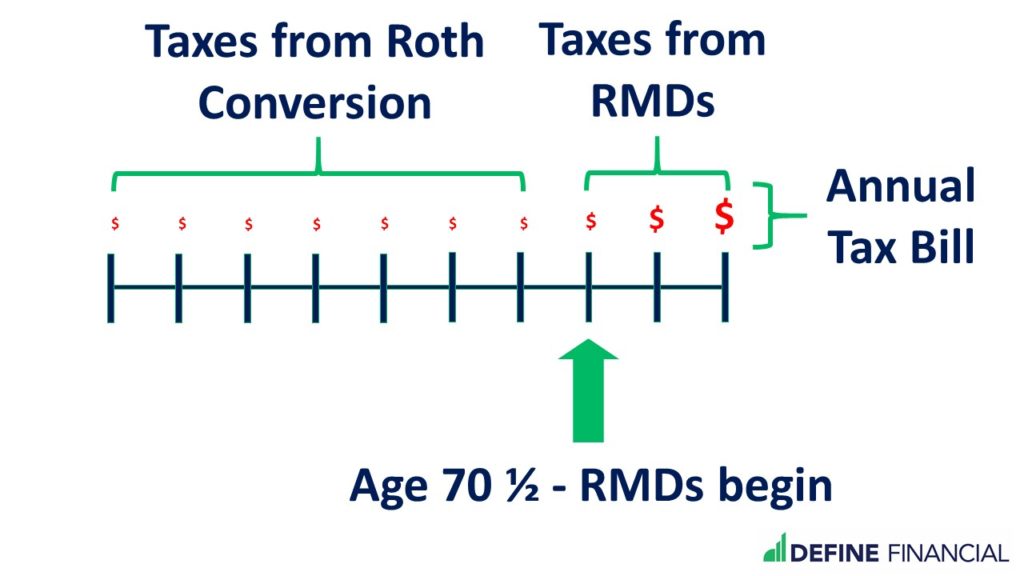

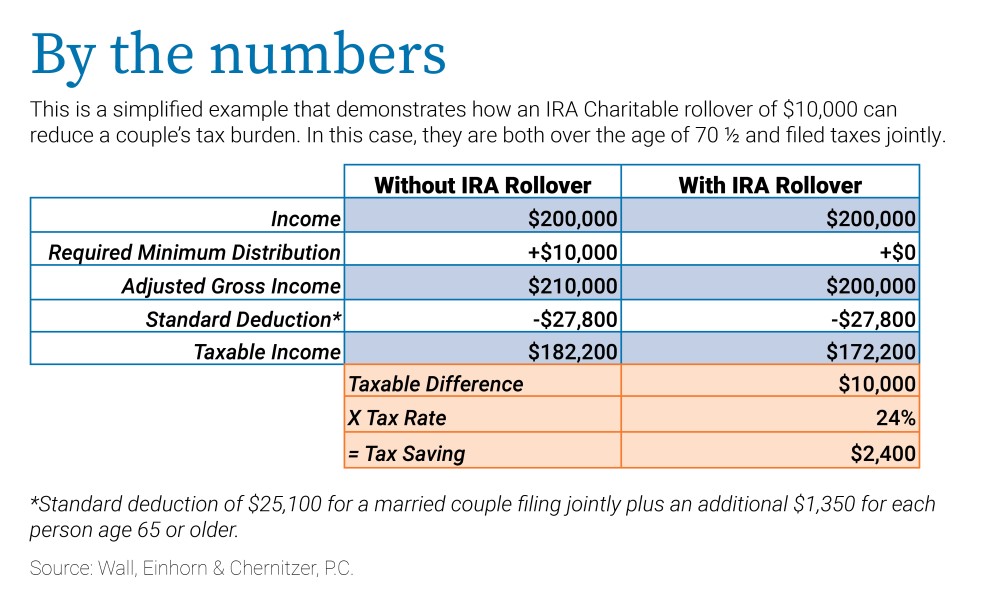

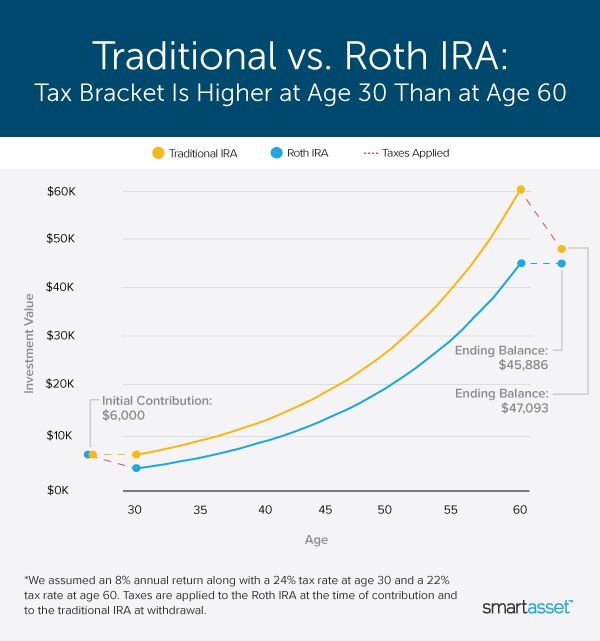

Generally, the longer you can wait to pay taxes, the better. How much will contributing to an ira reduce my taxes? For example, if you are married with no dependents, you might be able to take as.

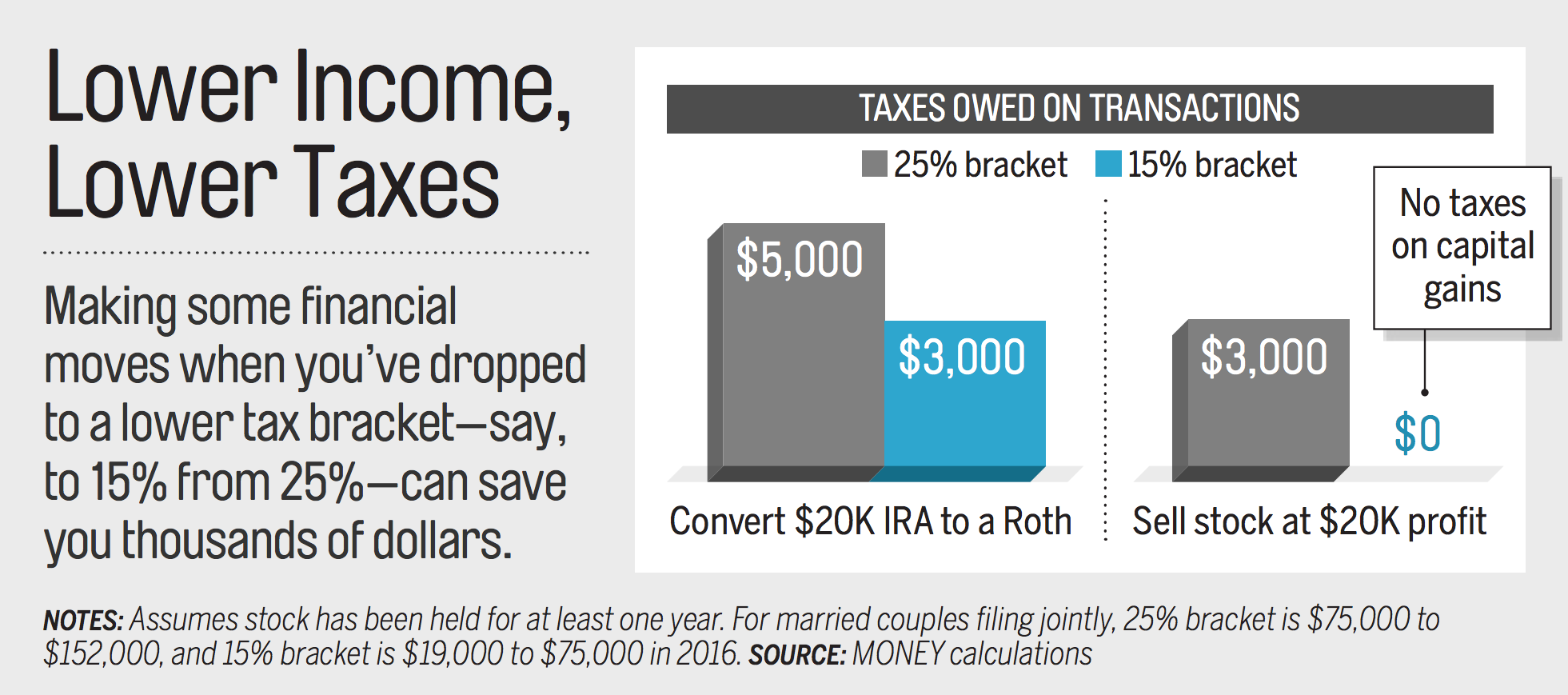

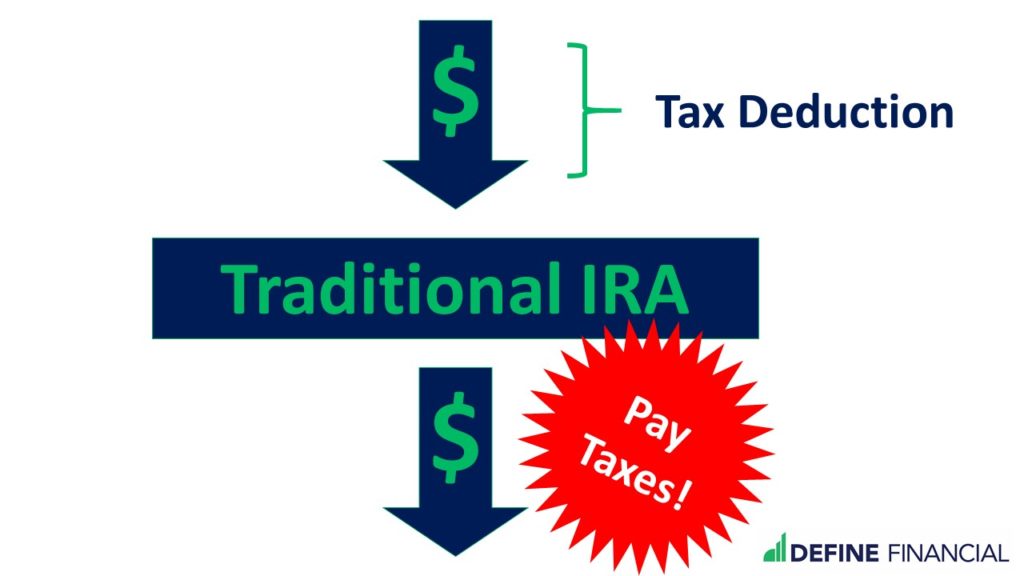

Deferring income from the current year into the next is one way to delay paying taxes and reduce the current year's. You can defer paying income tax on up to $6,000 that you deposit in an individual retirement account. So say you're putting $5,500 in your traditional ira this year;

Enroll in an employee stock purchasing program if you work for a publicly traded company, you may be eligible to. How to reduce your magi. Consider taking a distribution from your ira up to the amount that would be taxable.

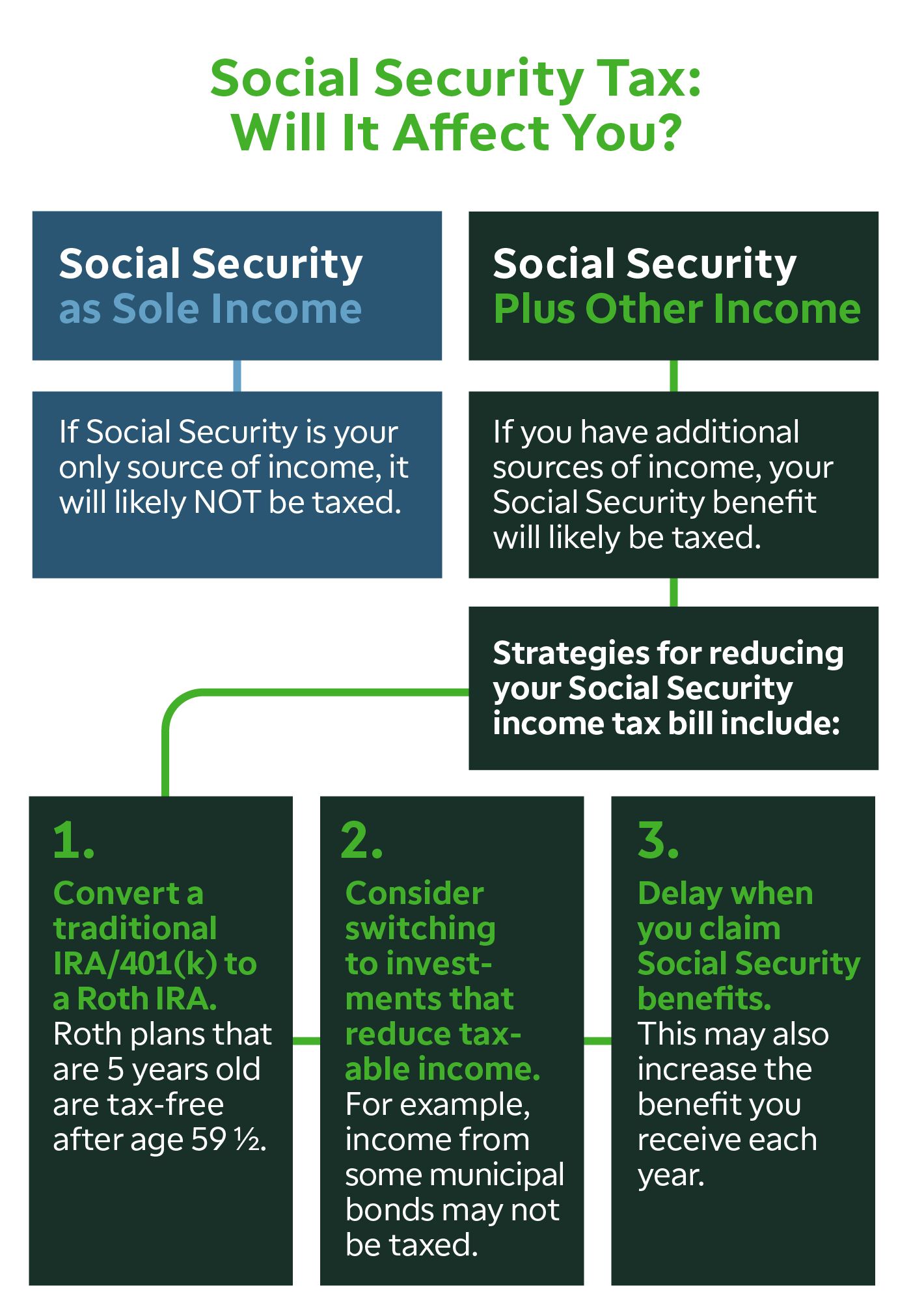

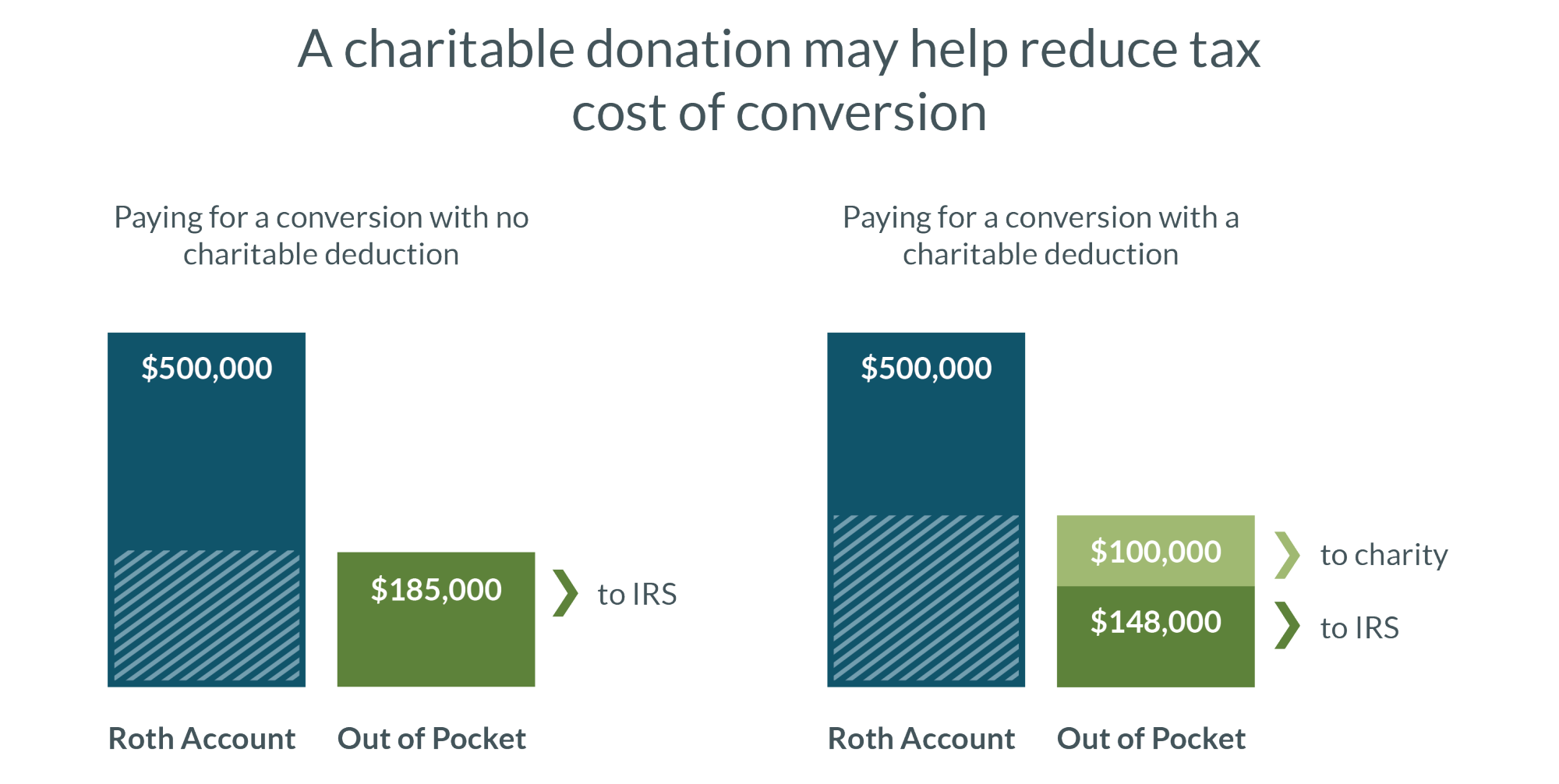

In the past, retirees have used various deductions including charitable cash contributions and gifting of highly appreciated. Your first step should be to make sure enough money is being withheld from your paychecks to avoid a huge tax bill—and underpayment penalties —at. A roth ira conversion may be right for you if your income is too high to contribute to a roth ira outright ($140,000 and up for individuals in 2021;

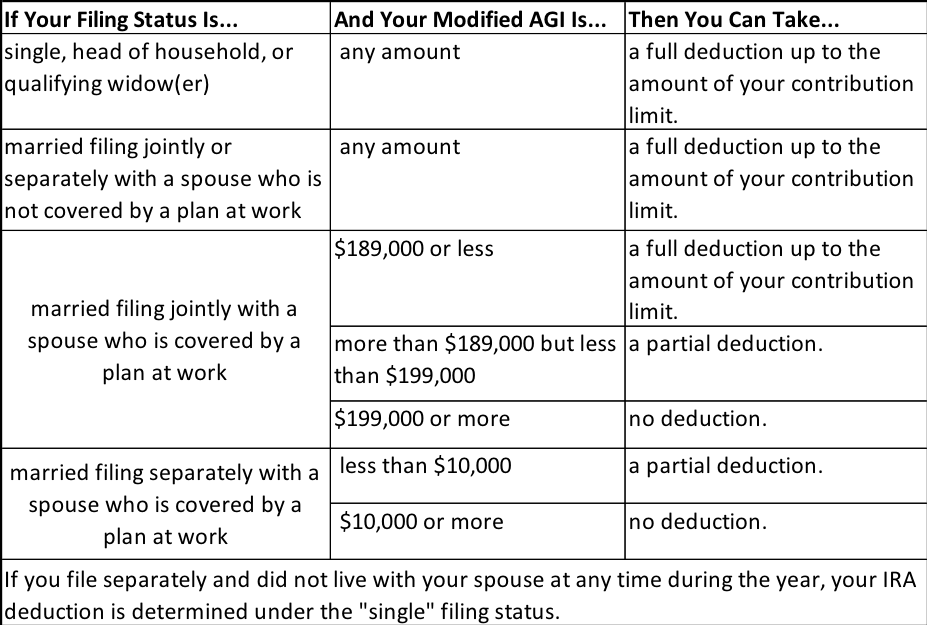

The contribution limit for 2019 is $6,000 or $7,000 for individuals age 50 or older. Step 1 fund a roth ira. If you meet certain requirements, you can deduct the full amount from your income.

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

:max_bytes(150000):strip_icc():gifv()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png)