Exemplary Info About How To Choose A Mortgage Broker

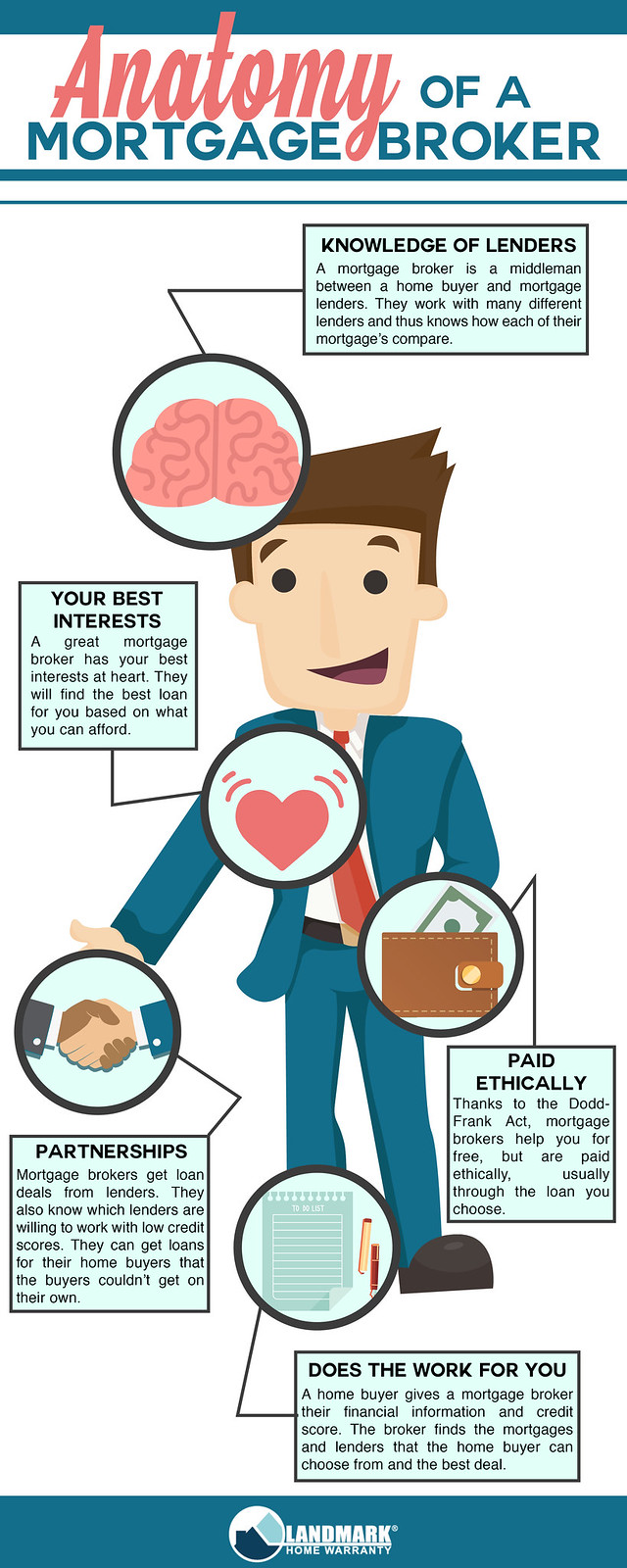

You want a mortgage broker with a good reputation for customer service to get you a mortgage to fit your needs.

How to choose a mortgage broker. Learn how to choose a mortgage broker, and contact the mortgage store to get started today! How to choose a mortgage broker? How to choose a mortgage broker.

There's basically two models, supported where you pay a share of your commission to the aggregator for leads such as aussie, mortgage choice,. When comparing brokers, try and find out how quickly they can start working. The quickest and easiest way to find a reputable mortgage broker is to ask people you know and trust who might have been involved in buying property recently.

Finance business, economics, and finance. Schedule interviews with at least three brokers. Check your credit score at least several months before you apply for a mortgage and work on improving it.

Ad compare top mortgage lenders 2022. There is a difference between a teaser rate and a rate that you can qualify for based on your income and credit. Once you have referrals, reviews, and recommendations, call around.

If you choose a mortgage with a fixed rate or discount rate that lasts for say 3 or 5 years, it’s usually a good idea to remortgage at the end of that promotional. Some of the common websites you can visit to research some potential mortgage lenders include. Ad increase your salary as an independent mortgage broker.

How to find a mortgage. Your schedule is one of the most important things to consider when looking for a mortgage broker. Look for someone you can work with on a personal level as well as a professional one.

:max_bytes(150000):strip_icc()/dotdash-090915-mortgage-broker-vs-direct-lenders-which-best-Final-c7e52f06ff4f41bca0744429ee1838e3.jpg)

![Top 10 Reasons To Choose A Mortgage Broker [Infographic]](https://infographicjournal.com/wp-content/uploads/2021/03/How-To-Choose-A-Mortgage-Broker.png)

/dotdash-090915-mortgage-broker-vs-direct-lenders-which-best-Final-c7e52f06ff4f41bca0744429ee1838e3.jpg)

:max_bytes(150000):strip_icc()/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

/dotdash-090915-mortgage-broker-vs-direct-lenders-which-best-Final-c7e52f06ff4f41bca0744429ee1838e3.jpg)